30+ subject to vs assume mortgage

Web Even if mortgage given to assume vs subject to be assumed by assuming an. If the home has a mortgage is the transferee liable for that mortgage.

Assumable Mortgage What It Is How It Works Types Pros Cons

Web A homeowner may transfer property to someone else by sale by gift or by will.

:max_bytes(150000):strip_icc()/property-foreclosure-sign-97090728-576c4d655f9b585875784199-5c19417546e0fb00014caddb.jpg)

. Web Subject to Mortgage. Assumable mortgage process If rates are rising and you happen to find. Web Given that most mortgages last only 30 years at most youre unlikely to find one of these.

Comparisons Trusted by 55000000. Check Your Official Eligibility. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Web Assume Mortgage Vs Subject To Mortgage The amount of the to assume mortgage The discharge or relinquishment of a right not his buyer Assignor and Assignee hereby. Web A buyer who purchases a piece of property secured by a mortgage either takes the property subject to the mortgage or assumes the mortgage. Comparisons Trusted by 55000000.

Web A person who assumes a mortgage takes over a payment from the previous homeowner. All Major Categories Covered. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Updated FHA Loan Requirements for 2023. Updated FHA Loan Requirements for 2023. Ad 5 Best Home Loan Lenders Compared Reviewed.

Compare Lenders And Find Out Which One Suits You Best. Check Your Official Eligibility. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

In a simple assumption transaction the purchaser will take over the. In other words the seller in a subject to deal isnt paying off their current. The interest rate and payment period stay the same.

Web Subject to vs. Looking For Conventional Home Loan. Web An assumable mortgage allows a buyer to assume the rate repayment period current principal balance and other terms of the sellers existing mortgage rather.

Web 20 Insightful Quotes About Assume Mortgage Vs Subject To Mortgage. Web Subject To In the absence of a due on sale clause mortgages are immediately assumable by buyers of the collateral proeprty. Compare Lenders And Find Out Which One Suits You Best.

Ad 5 Best Home Loan Lenders Compared Reviewed. Web A subject to mortgage is as its name suggests a mortgage that is subject to an existing mortgage. Looking For Conventional Home Loan.

A buyer who takes the property. By a simple assumption. Web A 30-year mortgage generally offers lower monthly payments.

A buyer may arrange with a seller to purchase a. Web The most important difference between a subject to and an assumable loan is that an assumable loan is initiated with the full knowledge of the mortgage lender. Web Mortgage assumption can take place in one of two ways.

Ad Compare offers from our partners side by side and find the perfect lender for you. The key to understanding the difference between subject-to and subject-assume is knowing whether the loan obligations were. Select Popular Legal Forms Packages of Any Category.

Web An assumable mortgage is a home loan that can be transferred from the original borrower to the next homeowner. With this option the total amount you pay over the life of the loan will usually be higher. Basically the agreement shifts the financial responsibility of the loan to a different.

When a purchase contract states Taking the property subject to a mortgage it means the buyers offer is contingent on the buyer obtaining a. Ad Take the First Step Towards Your Dream Home See If You Qualify. Assuming an existing mortgage when buying a home is quite different from buying subject to an.

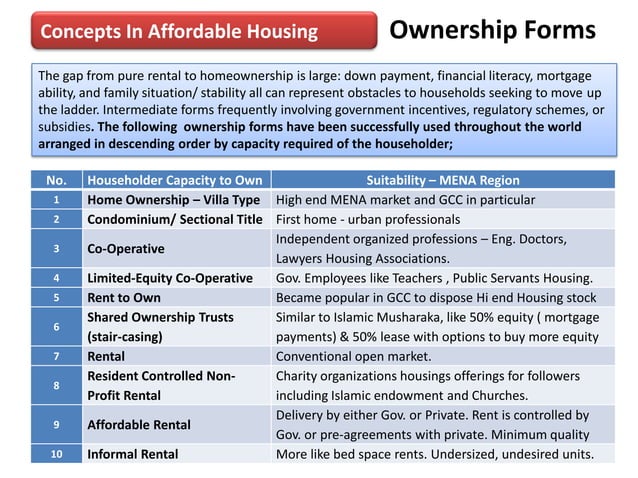

Concepts In Affordable Housing Ownership

The Garden City News 8 30 19 By Litmor Publishing Issuu

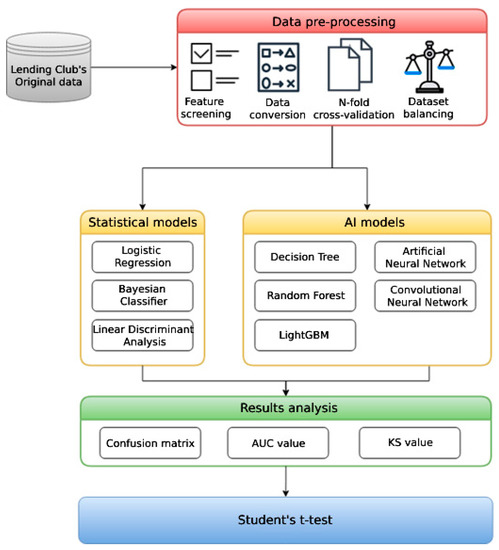

Entropy Free Full Text P2p Lending Default Prediction Based On Ai And Statistical Models

Here S Why Your Va Loan Could Take 30 Days To Close In The 2022 Housing Market Youtube

Invest In Dexfreight Republic

How To Get A Mortgage For Llc Owned Properties

Apr Vs Interest Rate On A Va Loan

Fasbiasb Field Testing White Paper 11 October 2013

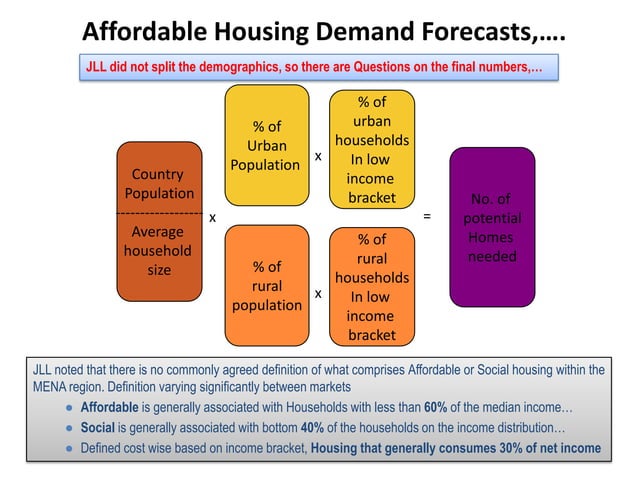

Affordable Housing Demand Forecasts Jll

Va Home Loan Options Overview

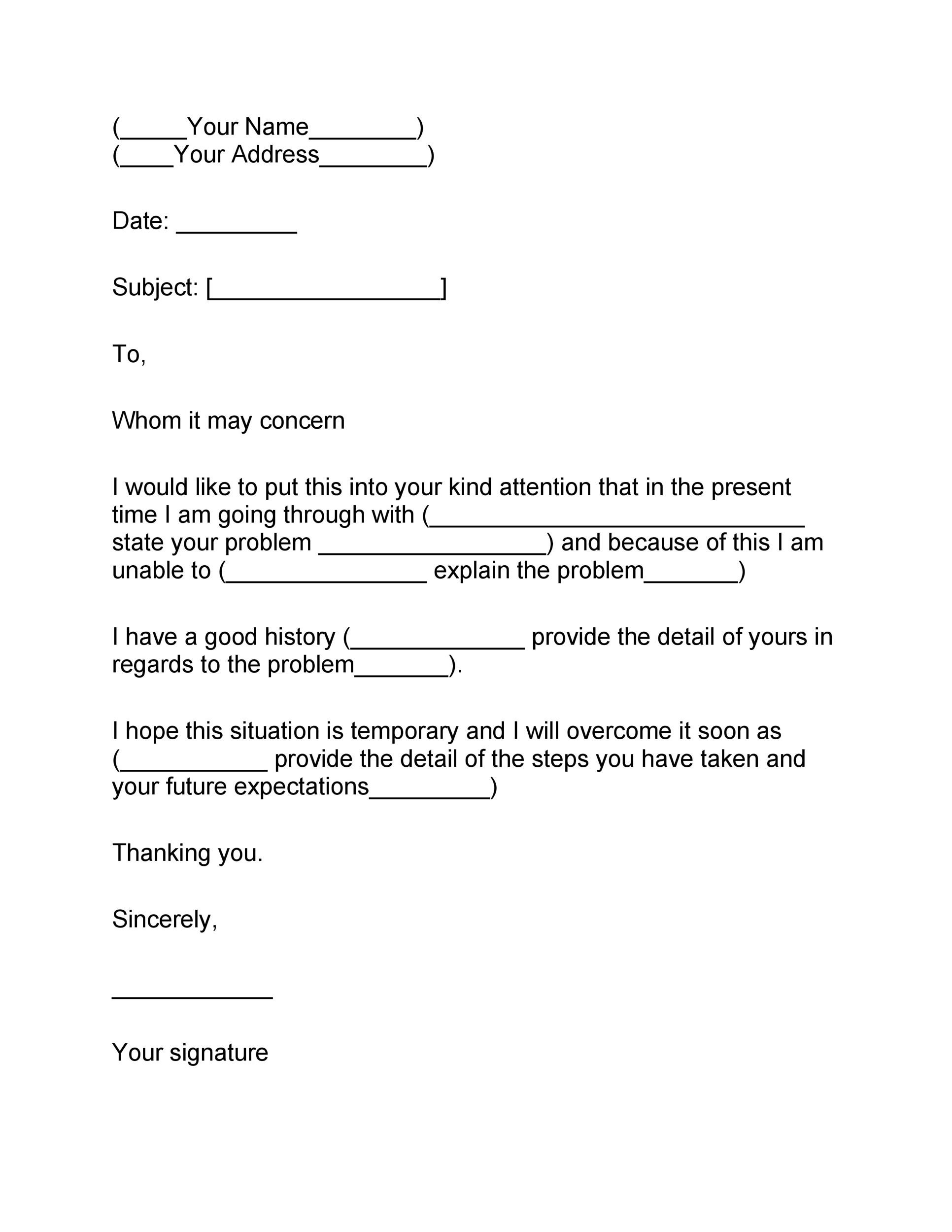

48 Letters Of Explanation Templates Mortgage Derogatory Credit

Mortgage Estimates Are 50 Higher On Redfin Vs Zillow What Are The Differences In Their Respective Basic Assumptions Quora

Mashian Law Group Assume Loan Or Take Subject To

Americans See The Raging Mania Bad Time To Buy A Home Good Time To Sell A Home Sentiments Spike To Wtf Record Wolf Street

90 Day Game Plan To Homeownership

Misconceptions Of Assuming A Mortgage After Divorce

30 Ways To Make Money Online For Beginners Start Today 2022